Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

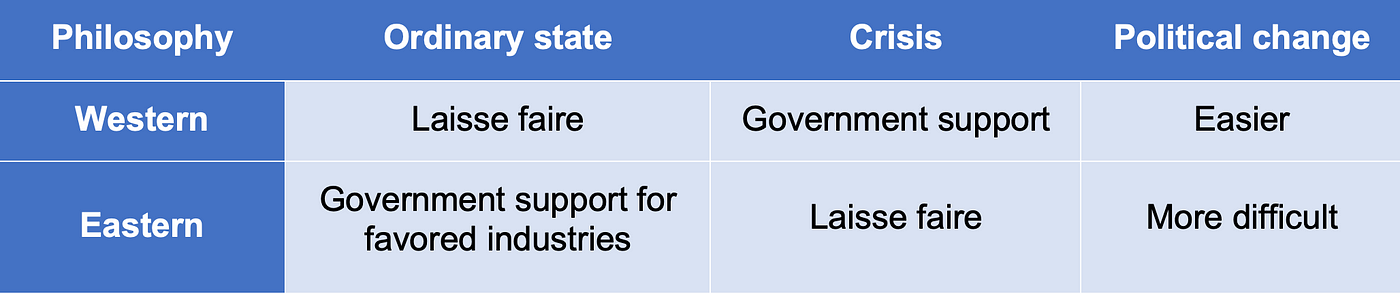

Eastern & Western Paths

Overview

It has been mentioned numerous times to analysts, “Please check your religion and politics at the door.” We write this installment not with the aim of espousing one political system over another but to assist sophisticated institutional investors and risk managers in understanding recent developments and better-predicting outcomes.

The Nub

In a relatively short period of time, China has become an economic powerhouse. However, a recent slowdown and a massive overhang of debt and overbuilding have the potential to cause global pain.

Western Approach

An underpinning of the economic approach in the United States is that espoused by Adam Smith in his Invisible Hand treatise¹, whereby individuals act in their own self-interest and thereby help the broader society.

This view was tempered during the Great Depression, whereby Keynes espoused government intervention to make up for the loss in consumer demand to spur the economy². Some permanent social welfare programs were also introduced, most notably Social Security, though with the intent to reduce the labor pool. Social welfare programs would greatly expand three decades later under President Johnson’s “Great Society” including food stamps, Medicare, and Medicaid. Similar programs have been introduced across the Western world.

Many argue that interventionist fiscal and monetary policies have been too costly, particularly considering the inflationary and debt impact of such policies during the Covid lockdowns.

Eastern Approach

In contrast, in China, the state is at the center of much development, with the state providing significant support to targeted industries. Like Japan, China has allowed key international firms into the market to learn and then created effective barriers to benefit its domestic firms³. Hence, as we speak, China has become a leading producer of electric automobiles, solar cells, and batteries.

In addition to the development of key industries, the state, particularly local governments, has been involved in facilitating the buildout of housing and infrastructure. The upside has been unprecedented speed in the initiation and completion of projects. The downside has been the same, with many of the projects being uneconomic, thereby resulting in a massive overhang in housing and a collapse in prices.

Dealing with the Problem

While the Western approach has its flaws, it is hoped that the private sector is sufficiently careful to minimize overbuilding. One could argue that during the Savings and Loans Crisis⁴, there was, in fact, overbuilding in part because of the liberalized lending policies of the Savings and loan associations and Government-sponsored enterprises. The problem was addressed through the Resolution Trust Corporation.

The issue likely needing the most attention is the apparent inaction of the Chinese government regarding its current problems. When it was suggested that depression-related deflation might result without state intervention, per the WSJ, Xi was unmoved:

“Xi was unperturbed. “What’s so bad about deflation?” he asked his advisers, people close to Beijing’s decision-making said. “Don’t people like it when things are cheaper?”

⁵

Outcomes

Therefore, if (i) Xi remains the key decision-maker in China (which is likely) and (ii) he does not shift his views (which also appears unlikely), China might export deflationary prices. Offsetting this in America and the EU might be the tariffs that have been proposed (thereby increasing deflationary pressures). One might conclude that China will have to relent because of pressure from its citizens. However, as demonstrated during the Covid lockdowns, (where some buildings were reportedly sealed to keep people from leaving), its citizens endured significant pain and would likely do so again in the future.

Conclusion

Eventually, markets clear, but the issue for our clients and friends is what is likely to happen in the meantime. Unless checked, some Chinese businesses might face increased pain.

Sources

[1] https://en.wikipedia.org/wiki/Invisible_hand

[2] https://en.wikipedia.org/wiki/Keynesian_economics

[3] https://www.trade.gov/country-commercial-guides/japan-trade-barriers

[4] https://www.federalreservehistory.org/essays/savings-and-loan-crisis

[5] WSJ, Dec. 24, 2024, “Xi Digs In As Debt Piles Up”