Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

California Dreamin’

Overview

For many, California is the haven for free expression, beautiful climate, the entertainment industry, and a laissez-faire approach toward marijuana and other drugs. That dream is rapidly turning into a nightmare for some, with the loss of property and life, combined with an ever-increasing cost of living.

According to The Mamas and the Papas California Dreamin’:

“All the leaves are brown (all the leaves are brown)

And the sky is gray (and the sky is gray)

I've been for a walk (I've been for a walk)

On a winter's day (on a winter's day)

I'd be safe and warm (I'd be safe and warm)

If I was in L.A. (if I was in L.A.)

California dreamin' (California dreamin')

On such a winter's day”

More Dreams

The dreams continued with what appear to be severely misguided regulations on land and water use. The unfortunate reality is that much of California is prone to periodic fires (and earthquakes), yet homeowners were blocked from taking steps to reduce their collective vulnerability to fire threats¹. Additionally, fire-fighting water supplies were unavailable apparently due to environmental concerns.

The likely upshot includes easing some land use regulations, filling reservoirs, replacing some politicians, burying powerlines, and implementing building code changes—fairly predictable outcomes.

Eastern Approach

Now for reality. The losses from the fires have been estimated as high as $50B:

“Total economic losses from the fires are now pegged at close to $50 billion, double the estimate of a day earlier, according to J.P Morgan analyst Jimmy Bhullar. That includes insured losses which he estimated at more than $20 billion and “even more if the fires are not controlled.” ²

According to Fortune magazine:

The wildfires are shaping up to be one of the worst disasters in U.S. history. AccuWeather’s latest estimate puts the total damage and economic loss at $250 billion-$275 billion. Meanwhile, CoreLogic estimated that insured losses from the fires could reach $35 billion-$45 billion.³

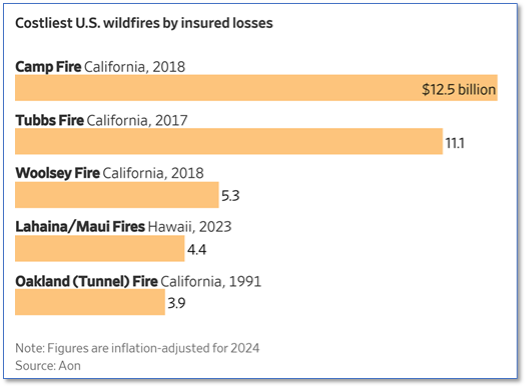

As can be seen in the illustration below, the losses far exceed those of previous fires:

Typically, losses are absorbed by insurance companies. However, many insurance companies have exited or reduced their exposure to California fire risk, leaving the state’s FAIR plan to make up the difference. However, the total capital for FAIR is merely $377M⁴, as it uses a Social Security-like approach of pay-as-you-go. This leaves the question of how the gap might be covered. Had this disaster occurred before the change in the White House, there would have been a good chance that the federal government would have stepped in. Under the current administration and its focus on cost-cutting, the probability of significant assistance seems minimal.

Possible Solutions

Since FAIR is a state entity, watch for a program in which all California homeowners are assessed a fee to cover the costs over time⁵. One might argue that such a fee is inappropriate, but the state is likely to use a sovereignty defense. The alternative is for homeowners to sue FAIR if reimbursements are delayed or not forthcoming. These suits might also be unsuccessful, as FAIR might be forced into bankruptcy or claim a form of sovereign immunity.

Significant Exposure

Obtaining accurate information on adjusted exposure relative to capital is challenging for insurance companies. Additionally, some firms have exited, although some have attempted to disengage recently. Below is a quote that might be helpful:

“The situation is worsened further as several major insurers have pulled out of the California market in recent times. AIG announced its exit from the admitted homeowners’ market in 2022, while Chubb and Allstate have also limited their offerings. State Farm exited last year, taking 72,000 home policies with it. This loss of capacity is contributing to an underinsurance issue in the state."

⁶

Conclusion

Regardless of the eventual outcome, homeowners are likely to face delays in reimbursements, shortfalls in coverage relative to rebuilding costs, and extended periods without housing. For insurance companies providing coverage, the losses appear to exceed previous expectations. For all California taxpayers, these recent events are a reminder of the disconnect between the dream and reality.

Sources

[1] https://news.stanford.edu/stories/2021/08/04/new-wildfire-strategy-california

[2] https://www.wsj.com/us-news/los-angeles-fires-recovery-costs-billions-12201ee5?mod=djemMoneyBeat_us

[3] https://fortune.com/2025/01/18/fair-plan-la-wildfire-exposure-5-billion-palisades-eaton-claims-payments-reinsurance/

[4] https://fortune.com/2025/01/18/fair-plan-la-wildfire-exposure-5-billion-palisades-eaton-claims-payments-reinsurance/

[5] IBID

[6] https://www.insurancebusinessmag.com/us/news/catastrophe/los-angeles-wildfires-burn-through-the-insurance-industry-519917.aspx