Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

The Three “Threes” and the new Economic Order

Overview

U.S. Treasury Secretary is pursuing a plan for 3% real economic growth, a reduction in the deficit to 3% of GDP, and an increase in oil production of three million barrels per day¹. However, the high tariffs, high U.S. dollar, and higher U.S. sovereign debt burden are an impediment to the “Threes” goal. Add to the mix a restructuring of the global structure, and you have an upending of the best-laid plans.

Method to the Madness

Henry Kissinger suggested that the best path forward was to separate America’s two greatest adversaries: Russia and China². While some of Trump’s statements are antithetical to the Neo-Conservatives and Democrats, the impact appears to mark the beginning of pulling Russia away from China. What was particularly irritating to many in the EU leadership were the comments of Vice President Vance, who stated that the greatest threat to Europe was not Russia but rather its own policies.

Additionally, forcing Ukraine (and the EU) to the negotiating table and pursuing mineral rights in Ukraine appear to fit the pattern of a shift in the global order.

A few other items of note are Trump’s positive comments on North Korean leader Kim Jong Un³ and his previous comments on Greenland, Canada, and the Panama Canal.

The “trick” for the Trump administration is a resetting of the global order while trying to place the economy on a sound footing. In addition to the obvious cutbacks in the federal government, curtailment of foreign aid, a review of entitlement programs, and broad-ranging tariffs, we expect there will be some concessions requested for Canadian security⁴.

Portfolio Impact

President Xi prides himself on being among China’s greatest leaders. With the exception of Mao, no leader has served a longer term. Furthermore, if Xi succeeds in taking control of Taiwan, some believe he might even surpass Mao.

However, there are a few obstacles to address:

- Taiwan Strait – Taiwan is separated from China by a 100-mile strait, thereby making a landing difficult. In contrast, the English Channel was only 20 miles wide and yet D-Day was extremely difficult.

Offset: Perhaps China can control choke points such as airports, train stations, the internet, and media to gain time and space for an invasion.

- Imports – China is highly dependent on imports for its food and energy, its shipping lanes can be interdicted at numerous points in the Middle East, the Indian Ocean and the Straits of Malacca.

Offset: Perhaps in a few years China will have the capability to police such routes with its growing aircraft carrier fleet.

- Three Gorges Dam – The dam could be breached by several high-powered missiles, flooding cities and endangering millions of lives downstream.

Offset: In a totalitarian state, the loss of 10 to 15% of the population is not a catastrophic event and might serve to harden public resolve for additional sacrifices, yielding similar effects that the bombing of civilian populations had during World War II.

- Nuclear – While the threat of nuclear weapons is always there, perhaps it is a non-option considering the cost of this escalation is massive and immediate (i.e., it takes about 10 minutes for warheads to reach targets within continents and 30 minutes to reach targets across continents).

Middle East

Unfortunately, this area has been at arms for decades and perhaps has become more vulnerable due to Iran’s growing nuclear capabilities. The shuttering of the Red Sea via Iran’s proxy, the Houthis, makes the situation even more dangerous.

Nonetheless, there is hope for peace as the factions realize more can be gained through peace than conflict. Additionally, continued growth in solar and wind power might reduce dependency on Middle Eastern energy.

Conclusion: A Better Path

Over time, conditions and views change, and with them, behavior. If Mr. Musk is correct, then in the next couple of decades, energy, products, and services will trend towards zero cost with continued advancements in relatively cheap solar power, robotics, and artificial intelligence. In England, as a result of the Industrial Revolution and a reduction in cost of transportation, the value of agricultural land plunged relative to resources tied to the Industrial Revolution (i.e., companies and urban land). Perhaps the same shift will occur for countries where control of land is less important than the resources used to provide for the needs of the population.

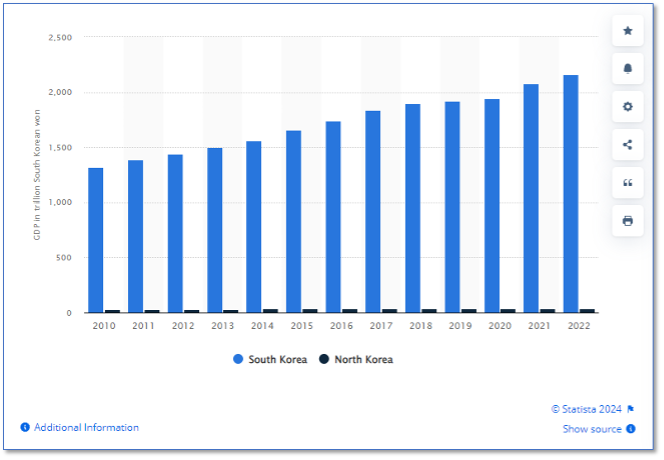

Perhaps this notion is supported by the divergent paths taken by North and South Korea. While the landmass and climate of both countries are similar, the insular North Korea has made little progress compared to the more open South. Hence, it is not the landmass that is relevant but rather the policies and procedures employed.

Hopefully, some actions will be taken over the next several years to reduce the frequency and intensity of conflicts.

Sources

[1] Bloomberg Odd Lots, February 21, 2025