Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Tenure doesn't matter from Wealth-Focused Perspective

I. Recent Trends

The past few years have seen a noticeable increase in the number of proxy advisory firms and activist investors pushing for director tenure limits. Behind the push is the theory that a director who has been on the board for too long – nine years is generally considered the tipping point – can no longer be considered independent. It’s also sometimes assumed that directors who have been on the board for an extended period are not up to date with recent technological changes in the industry or can become complacent in their duties.

Modern corporate governance theory suggests that the effectiveness of a director over time is a parabola, where for a period of time, the director becomes increasingly effective as they learn the business better. However, after a few more years pass, the director loses their independence and their effectiveness decreases. In response to this modern theory, two other major proxy advisory firms are increasingly recommending against the reelection of directors whom they see as “over-tenured.”

Additionally, foreign markets such as China¹ and the U.K² are considering moving in the direction of proposing mandatory tenure limits or strongly recommend such limits. While most S&P 500 companies do not currently have a tenure limit in place, many do have age limits which intend the same result.

II. The Question

The question, then, is whether it is in the best interest of shareholders to place a limit on a director’s tenure or if the issue is, in reality, more complex than that.

In the case of Apple’s management, they believe the issue to be more complex than that: at the 2024 Annual Shareholder Meeting, management recommended that Dr. Ron Sugar stay on the board despite hitting the age limit (75), citing his extensive experience and knowledge. Such a decision highlights that, despite having been on the board for 14 years (what modern corporate governance advocates would consider “over-tenured”) and despite hitting the predetermined age limit, management ultimately believed they could greatly benefit from his experience and knowledge.

Thus, those who support Dr. Sugar would argue that director retirement should be based on their performance as well as the needs of the company.

III. Case Studies

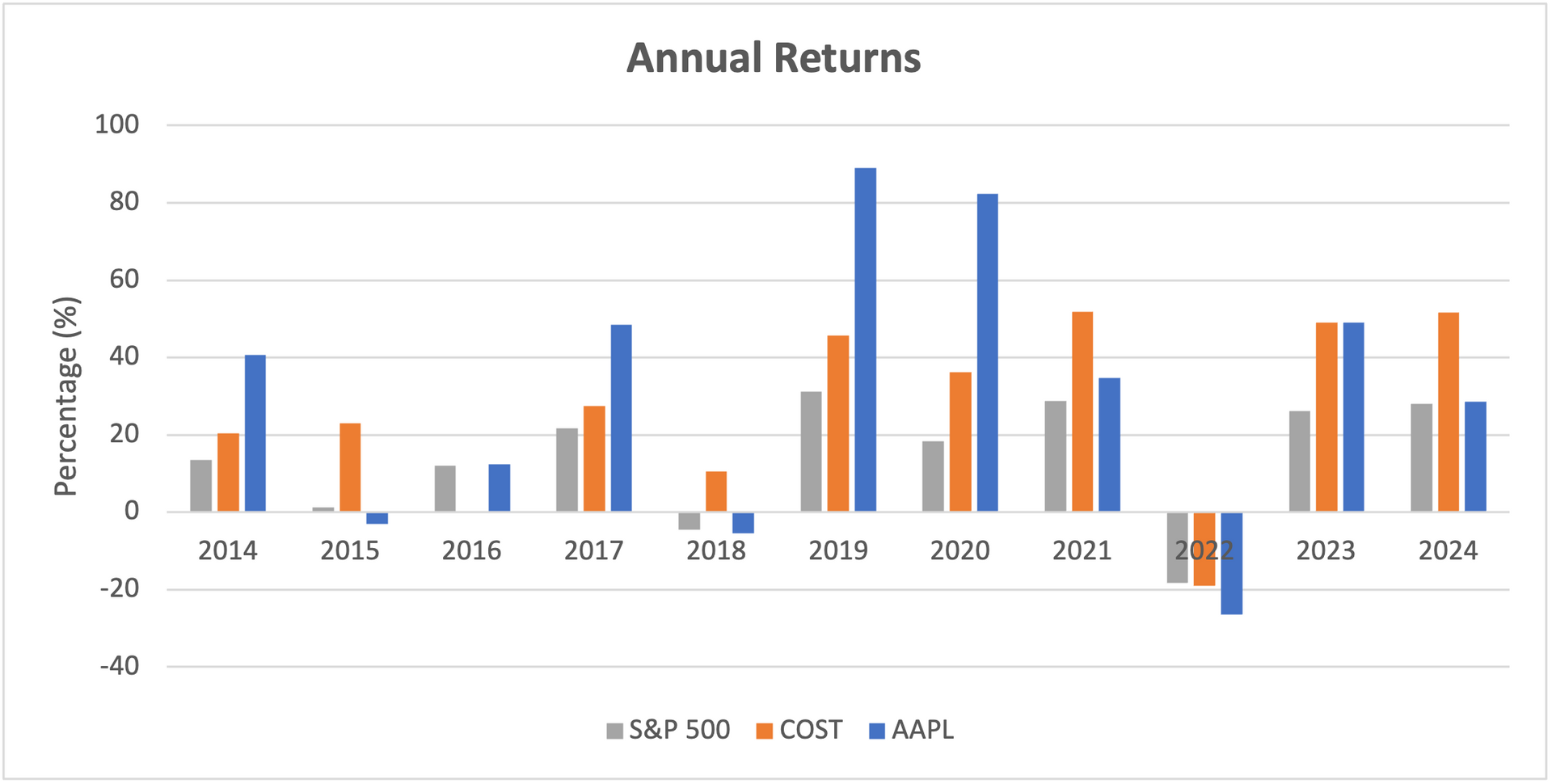

Corporations such as Apple (AAPL) and Costco (COST) show strong shareholder returns despite some long-tenured directors. In the case of Apple, independent directors serving 10 years or longer include Art Levinson (24 years), Andrea Jung (16 years), and Ron Sugar (14 years). Costco’s longstanding independent directors include Susan Decker (20 years), Hamilton James (36 years), and Jeffrey S. Raikes (16 years)³. Figure 1 shows the strong returns of these companies over the last decade compared to the S&P 500. Expect a comparison of affiliated directors vs non-affiliated directors at all major companies in a future installment.

Figure I: APPL and COST Total Shareholder Returns vs S&P 500

Recent studies have shown that the issue is too complex to establish a clear relationship between director tenure and board performance⁴. In fact, there are studies suggesting direct benefits of having at least one long-tenured independent director on the board⁵. The latter Harvard Business Review article⁶ suggests, however, that boards should have no more than one or two long-tenured directors – but again, examples of AAPL and COST argue otherwise.

IV. One-Size-Fits-All?

Of course, proxy voters have different interests. For those voters who seek to maximize shareholder return, perhaps the question to ask isn’t “How old are they?” or “How long have they been here?” but “Are they positively impacting shareholder return?” and “Will they continue to?” These common questions to ask for any employee.

A proxy voter focused on promoting governance practices at their portfolio companies may ask additional questions, which include “has the director been an active participants at board and committee meetings?” or “what unique perspective can the director bring to the board?” or “are they independent and thus can adequately oversee management?”

There are numerous other board and director characteristics for which a one-size-fits-all policy doesn’t work, such as mandating a precise board size, mandating an average tenure length, or mandating refreshment frequency.

Egan-Jones offers proxy voting policies to guide our customers on how to consider particular proxy proposals according to their interests. Egan-Jones also submits votes for customers and provides N-PX reporting.

Sources

[2] https://www.iod.com/resources/governance/how-long-should-a-director-serve-on-a-board

[3] https://s201.q4cdn.com/287523651/files/doc_financials/2024/ar/FY24-Proxy-Statement.pdf

[4] https://www.sciencedirect.com/science/article/abs/pii/S002463012200036X

[5] https://onlinelibrary.wiley.com/doi/abs/10.1002/smj.3370

[6] https://hbr.org/2024/12/research-why-your-board-should-include-a-long-tenured-director