Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Matthews International: Time to Reverse Course

Egan-Jones provides best-in-class proxy guidance, voting, and NP-X reporting →

schedule a meeting

I. The Headline

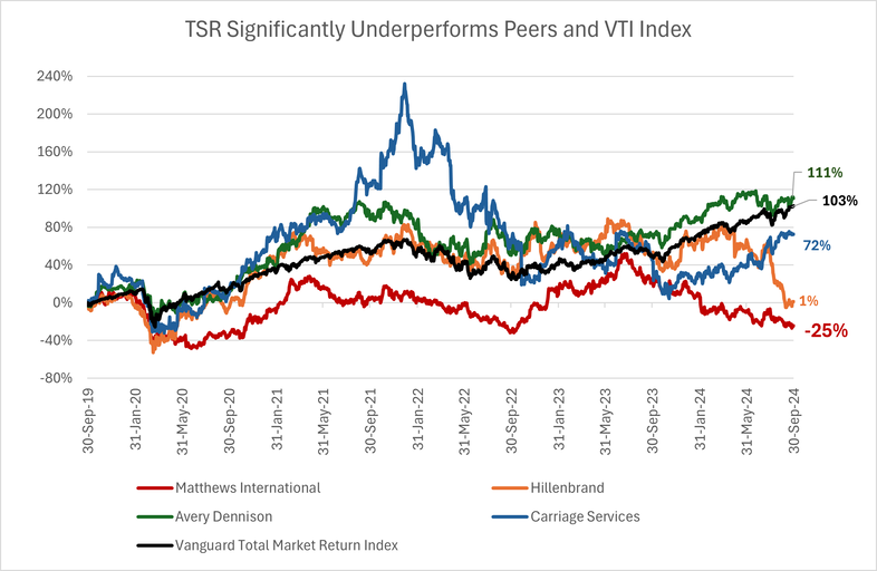

For the past two decades, Matthews International Corporation has underperformed relative to the market and peers. Thus, Egan-Jones recommends that shareholders vote FOR the three candidates nominated by activist investor Barington Capital. We believe the board has failed to properly steward the company, yielding poor returns due to the following:

- Acquisition of businesses unrelated to core expertise (memorialization)

- Costly debt burden

- Insufficient expansion of core product

II. What went wrong?

1. Acquisition of businesses unrelated to core expertise: memorialization

Over the past decade, Matthews has spent almost $1B in acquisitions. Many of these acquisitions are for the Industrial Technologies segment. Specifically, they have been branching into manufacturing equipment that is used to produce lithium-ion batteries. Unfortunately, Matthews heavily relied upon Tesla as a buyer of this equipment, with whom they are now entangled in a lawsuit that has only recently been resolved in favor of Matthews. This has had numerous ill effects on the business, including higher interest payments on their debt, legal expenditures, and, of course, a lack of customers for their lithium-ion battery equipment..

Additionally, in 2014, Matthews purchased Schawk, Inc. for over $500 million to start their SGK Branding Segment. After a decade of underperformance, Matthews is now selling this segment. The transaction will be a combination of cash and equity, amounting to $350 million total consideration – significantly less than how much the segment was purchased for over 10 years ago.

2. Costly debt burden

In addition to unwise business acquisitions, the SG&A expenses and debt burden are unsustainable. Matthews has carried a substantial debt burden (over $800 million for each of the past five years) and is paying a high amount of interest on that debt (over $50 million for the 2024 fiscal year). Additionally, the SG&A expenses were almost $500 million in the 2024 fiscal year, which has only increased in recent years.

These expenses have led to a significant decline in free cash flow in recent years, reducing what is available for capital expenditures and debt repayment.

3. Insufficient expansion of core product

Finally, while the Industrial Technologies and SGK Branding Segments have been underperforming, the Memorialization segment continues to account for nearly 50% of the Company’s revenue. This segment provides stable, albeit small, growth of around 3% annually. Memorialization is where the company’s expertise lays, however, there has been a lack of investment in this segment.

Barington’s view, and ours, is that Matthews should shift focus onto their Memorialization segment and find adjacencies to it that will be high-growth opportunities. For example, Matthews could invest in the digital solutions space for funeral homes: software to aid with staffing, scheduling, purchasing, etc. Additionally, Matthews should consider expanding their memorialization business internationally to new markets. These types of opportunities are more well-suited to the Company’s expertise than the other acquisitions that have been made.

III. Conclusion & Recommendation

The TSR over Mr. Bartolacci’s 18-year tenure has been less than 10%¹: the current strategy at Matthews is clearly not working. Change is in order, and the Barington nominees are ready to enact it. The Egan-Jones Wealth-Focused policy offers recommendations purely on the basis of protecting and enhancing shareholder wealth. The current Board has not been protecting or enhancing shareholder wealth; therefore we recommend against the nominees put forward by the board, and for the nominees put forward by Barington.

Egan-Jones offers deeply considered vote recommendations that enable our customers to better align with their customers’ proxy voting goals. Egan-Jones also submits votes for customers and provides N-PX reporting. Contact

sales@ejproxy.com for more information.

Footnotes

[1] This figure is calculated using the adjusted closing price on October 2, 2006 (the day Mr. Bartolacci became CEO) and the adjusted closing price on December 9, 2024 (the day before Barington announced its proxy contest).