Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Massive Reset; Changing Expectations

Overview

From time to time, there are massive, seemingly unpredictable shifts that have far-reaching implications. Our view is that one of those moments is upon us.

Transportation

Our premise is rather simple:

- Electric and hybrid (“new tech”) vehicles are destined to become less expensive to own and operate than internal combustion engine (“ICE”) vehicles.

- Self-driving will become the norm within a few years.

- Traditional ICE vehicle manufacturers will face extreme difficulty in making the transition, so expect significant challenges for them.

Tailwinds

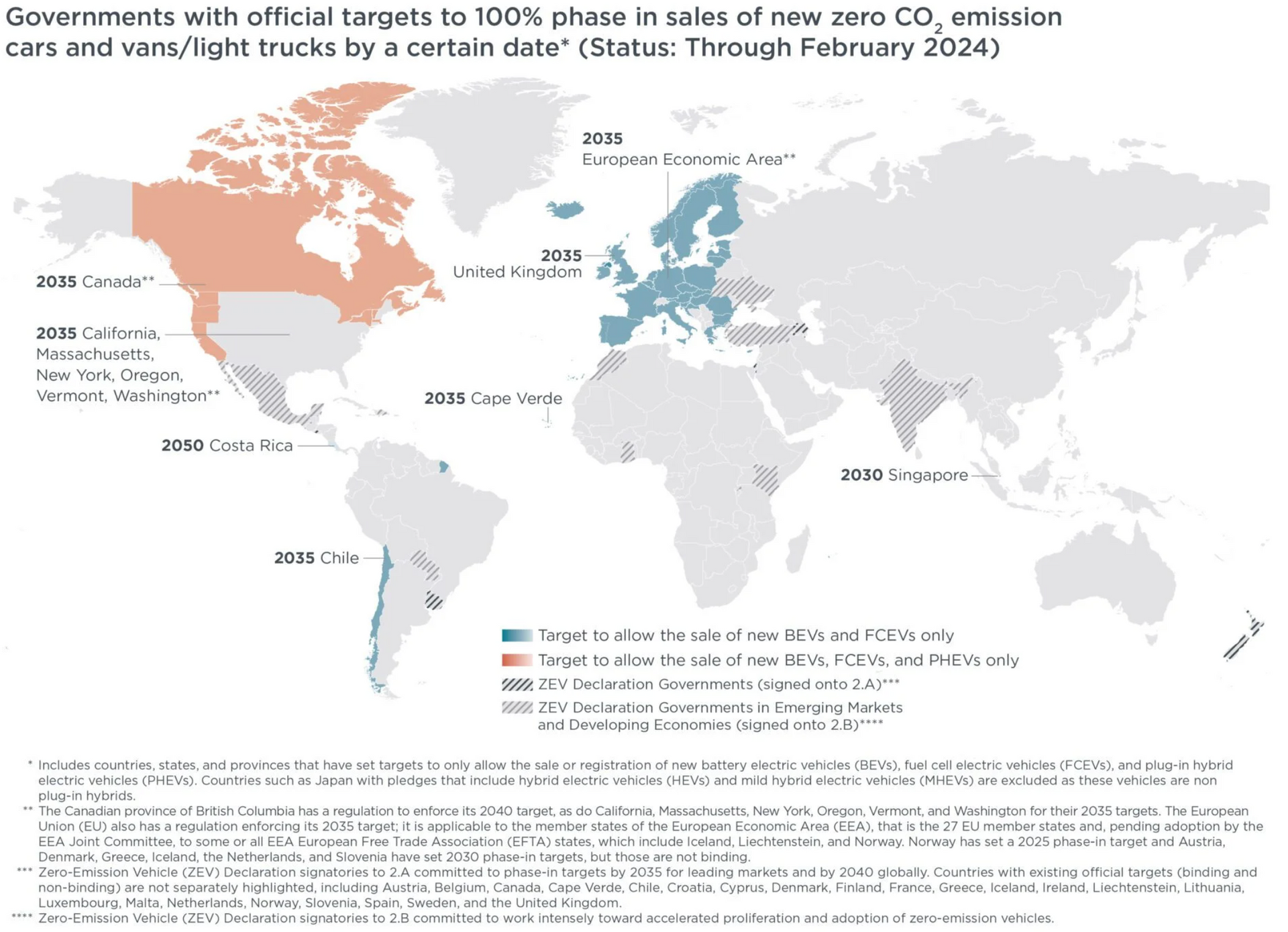

A. Government Regulations: Regardless of one’s views on climate change, a significant number of countries are planning on banning the sale of ICE vehicles. (See below)

B. Subsidies: Many governments, including the U.S., penalize ICE manufacturers for each vehicle produced and subsidize non-ICE manufacturers.

C. Manufacturing cost: BYD, a Chinese manufacturer, announced the sale of an electric vehicle for less than $12K, compared to the Nissan Versa at $18K. While the model falls short of many American consumers' expectations, more widely acceptable vehicles will soon enter the market, with Tesla suggesting a model at approximately $25K.

D. Self-Driving: Supervised self-driving is now available in numerous models globally, meaning the car can drive itself while the driver remains attentive. Unsupervised self-driving is expected to become the norm soon. With advances in AI, the superiority of self-driving over manual driving will likely be reflected in insurance rates.

E. Non-ICE manufacturers appear to have a substantial cost advantage with newer factories and non-union shops.

Impact

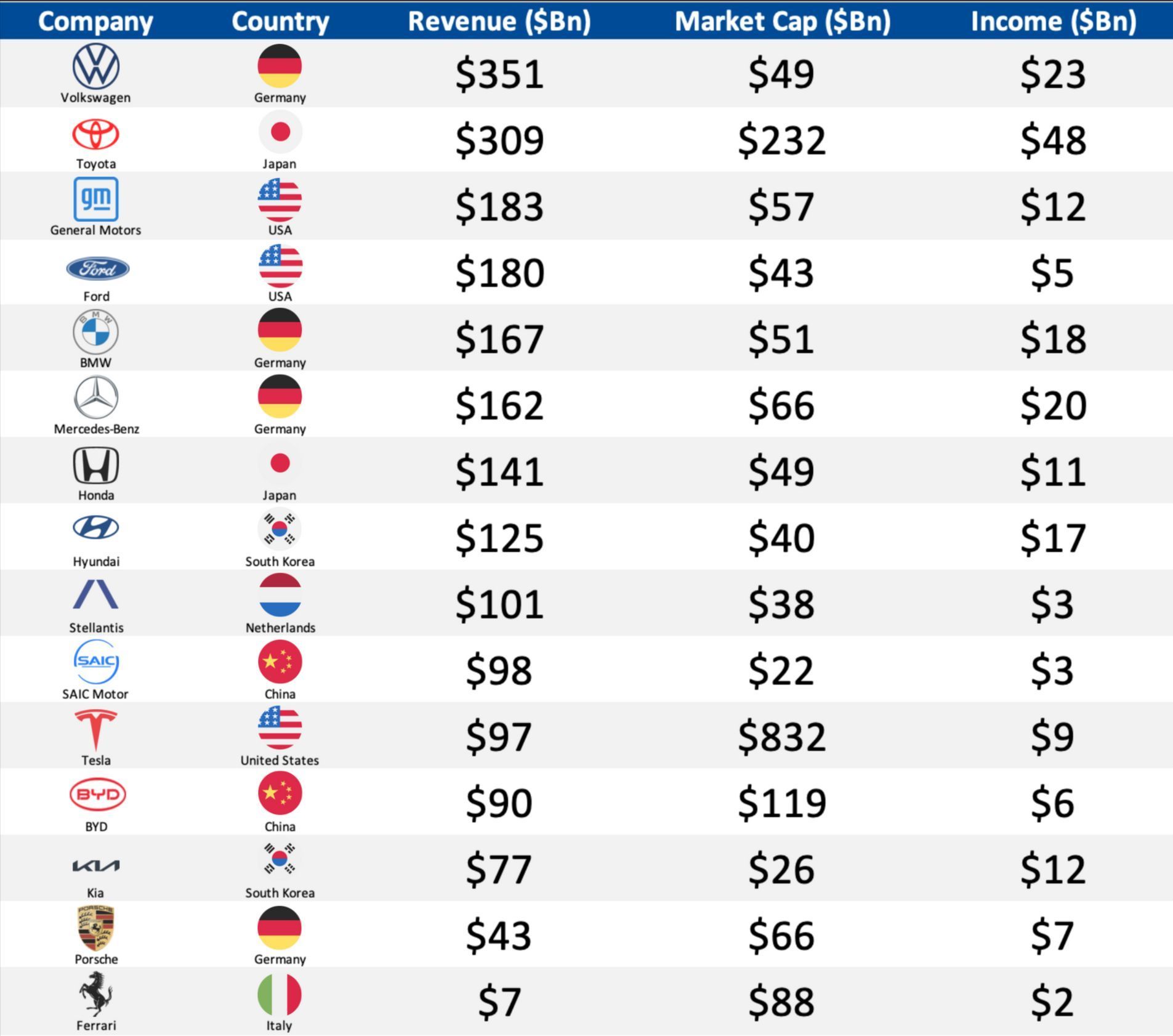

Whenever there is market disruption, the weaker firms suffer first. However, we do not expect it to be limited to the weakest, as the industry has significant operating and financial leverage. A small drop in sales typically has a significant impact on earnings. Perhaps we are seeing early signs of this with the recent drop in Mercedes’, Ford's, and VW’s earnings (each down 52%, 26%, and 33% YoY)¹.

However, given the massive impact of auto companies on a country’s economy, watch for more news over time. Assuming a typical German vehicle costs $50K, a family owns two, and the value over 5 years is halved, the lost value is $50K over 5 years, or $10K per annum. Given that the raw material in a vehicle is minimal (i.e., a few hundred dollars of steel, aluminum, rubber, and plastic), the wealth transfer is massive.

With the pending disruption, income loss will likewise be substantial. Hence, if our thesis is accurate, Germany may face significant adjustments.

Footnotes

[1] “Mercedes-Benz and Ford show Net Income; Volkswagen shows EPS.