Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Masimo’s Fate: Of Proxy Fights, Litigations and Board Control Shift

The Masimo board control debacle has finally come to an end. After over a year of battle with back-to-back proxy fights, Politan Capital Management, led by Quentin Koffey, has emerged victorious in the election of its two additional nominees.

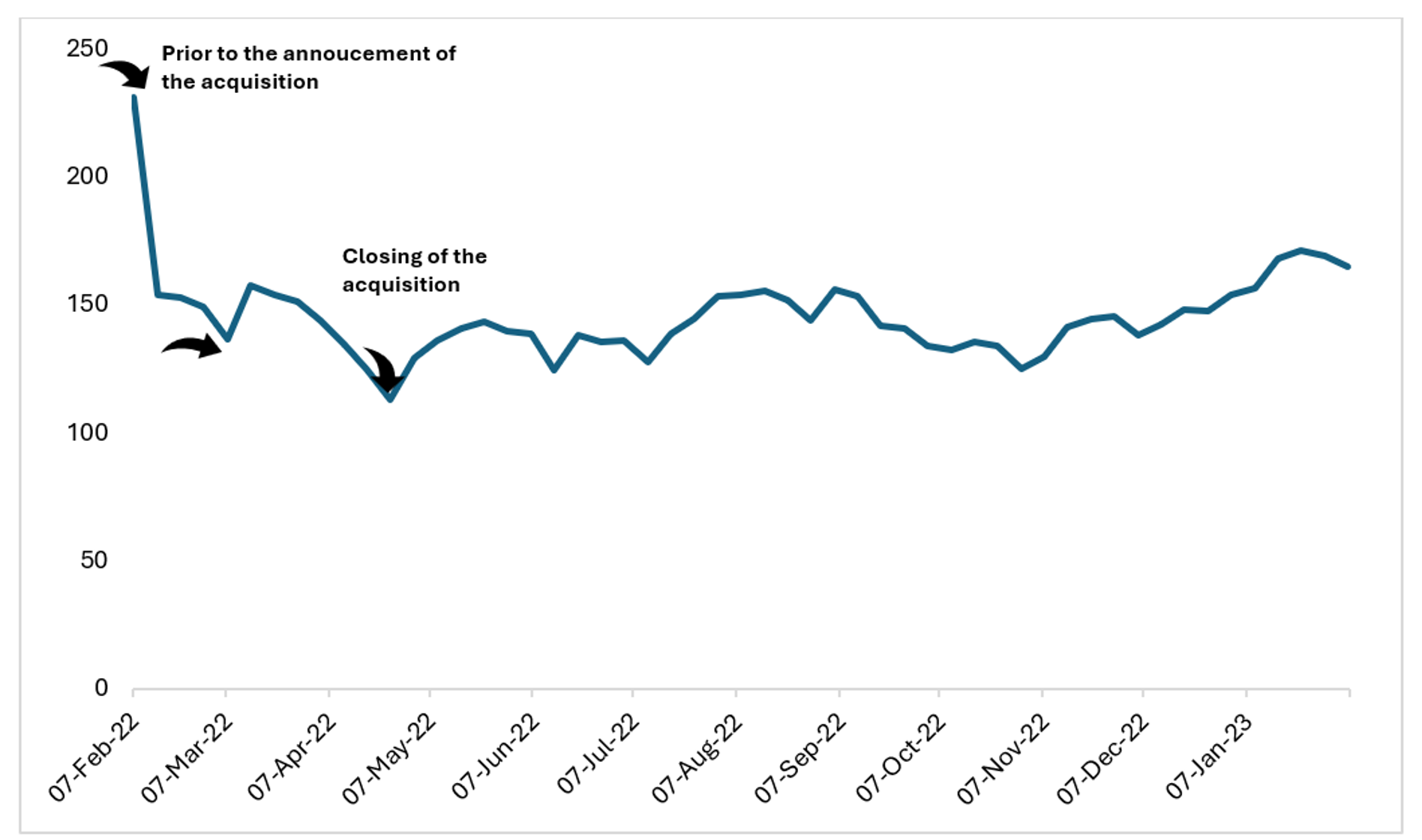

It all started with the 2022 acquisition of Sound United. The $1.025 billion acquisition price was unwelcomed by the market and Masimo’s stock plummeted drastically. As seen on the graph below, prior to the announcement of the acquisition, MASI’s adjusted price per share closed at $231.07 on February 7. However, upon the announcement of the acquisition, MASI’s shareholders were forced to watch that price fall dramatically to $144.20— a massive -37.6% in just two months. On April 12, 2022, Masimo announced that it had completed the acquisition, and its stock price tumbled by another 4.6% to $137.45.

Enter Quentin Koffey and Politan. For this group of activists, the case for change was rooted in more than simply underperformance — it was bolstered by a claim of minimal management accountability and lack of board oversight. At Masimo’s 2023 Annual Meeting, the three-year-old hedge fund nominated Mr. Koffey and Michelle Brennan, a former Johnson & Johnson Global Value Creation leader. The shareholders welcomed this change in the boardroom with over 70% of votes cast. Nothing less than a monstrous win for Politan.

Rather than heralding a new beginning for Masimo, the feud reignited as the company divulged its strategic plan to separate the consumer business, the terms of which were strongly opposed by Mr. Koffey.

Initially, Masimo conveyed two possible options: either selling the consumer business, or spinning it off into a new public company with Mr. Kiani serving at the helm as Executive Chairman. In strong opposition to both this plan and what were described as underhanded board tactics, Mr. Koffey again stepped into the ring, launching a second round of the proxy fight with existing Masimo management.

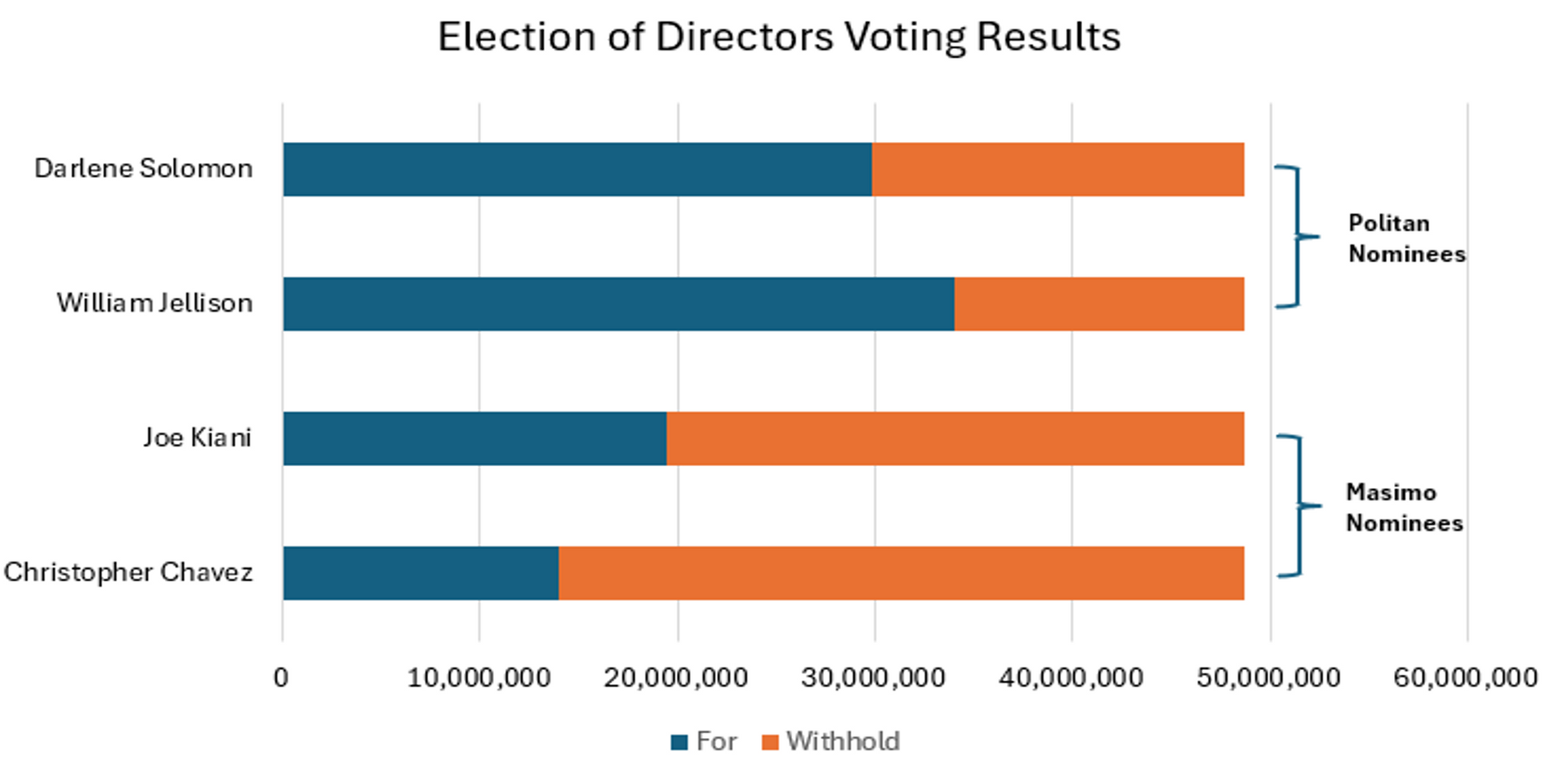

At the 2024 Annual Meeting, Politan nominated William Jellison and Darlene Solomon against Mr. Kiani and a newly nominated director, Christopher Chavez. This second proxy fight escalated into litigious warfare, beginning with Masimo suing Politan for allegedly including “material misstatements and omissions” in its proxy filings¹. In return, Politan followed suit after Masimo postponed its 2024 Annual Meeting, originally scheduled from July 25 to September 19. Adding fuel to the fire is Mr. Kiani’s intriguing, yet unsupported, theory that Apple is behind Politan’s board control determination. In December 2023, Masimo won an IP infringement case² filed against the tech giant over the use of patented blood oximetry in the Series 9 Ultra 2 Apple Watch, leading to a pause in the sales of said models.

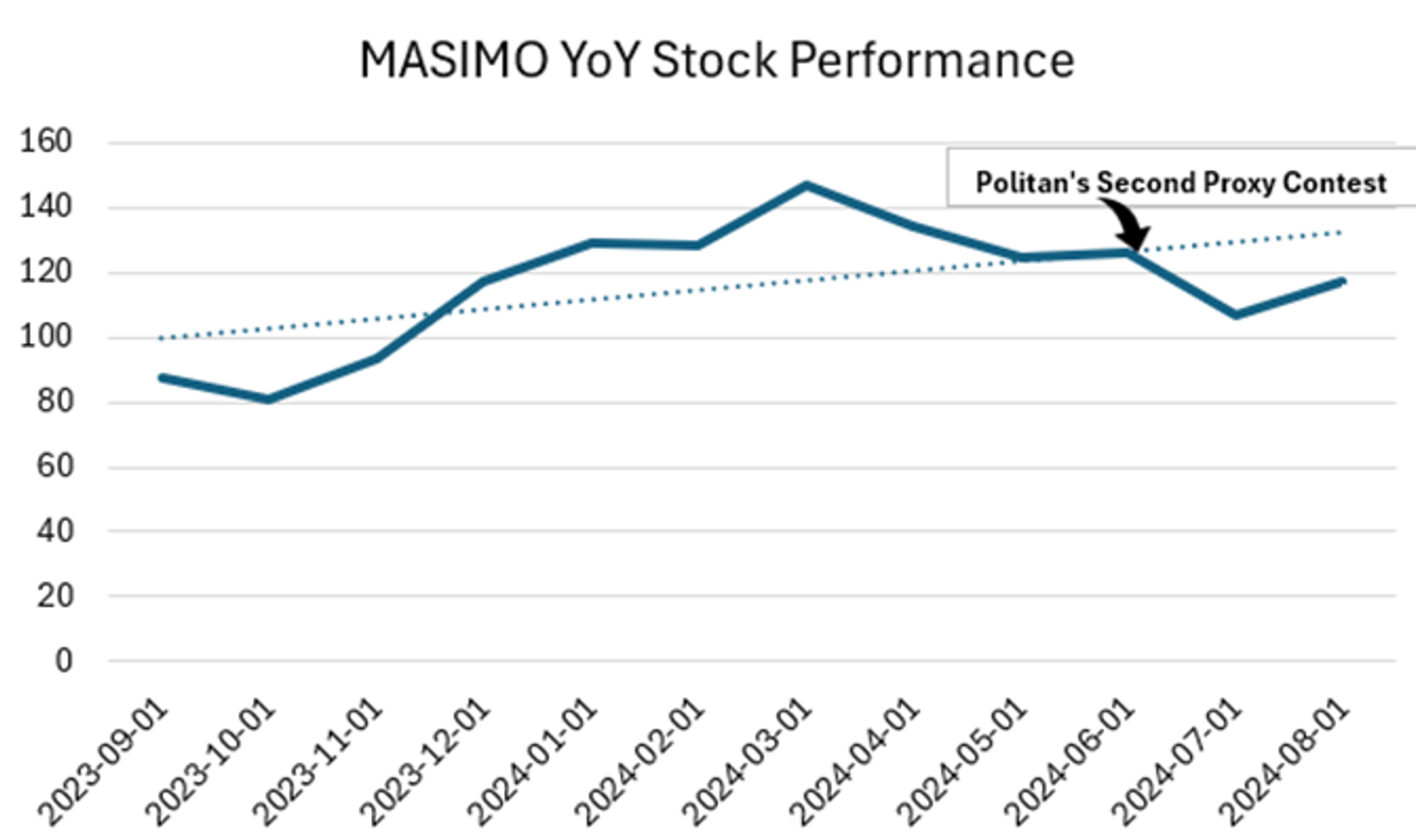

Regardless of the presence or not of any behind-the-scenes backers, yet another proxy fight has reflected in Masimo’s stock.As shown in the chart below, there was a positive shift in Masimo’s stock performance in Q2 2024, but that growth was disrupted coinciding with Politan’s second proxy contest. Despite the improvement in the company’s revenues and related financials, investors looking at another contest instead see an opened Pandora’s Box of uncertainty - from losing a reliable key-person in Mr. Kiani who is responsible for over Masimo’s 900 patents, the threat of employee attrition, and the unpredictability of board composition.

A few days before the Annual Meeting, Politan was found in contempt of court for violating a sealing order by making some information public while proceedings were still ongoing³. Shortly thereafter, Masimo announced its partnership with Google to bring its health technology in Wear OS by Google™ smartwatches⁴. While this confluence of events would appear to be wildly favorable to Masimo, it only coincided with a moderate 1.2% bump it’s the stock price during the period September 13-17.

Fast forward to the afternoon of September 19; Politan has declared victory as shareholders elected William Jellison and Darlene Solomon, joining Quentin Koffey and Michelle Brennan on the Masimo Board. This pivotal shift of events that ousted Mr. Kiani who founded and served as Masimo’s executive for more than 30 years, will leave the board composed of 2/3 of directors from the Politan side and 1/3 incumbent directors. On the same day, Mr. Kiani submitted his resignation as CEO and filed a court claim “seeking declaratory relief that he had validly terminated his employment for Good Reason.”⁵ Consequentially on September 24, 2024, Michelle Brennan was appointed to serve as the Company’s interim CEO.

Following this outcome and (hopefully) an end to hostilities, Masimo stock experienced a surge of 19.7% as of September 25.

What is next for Masimo? With the recent change in leadership, the market seems to approve of the outcome as reflected in its stock price. However, losing a dynamic founder who has been instrumental to the innovation engine of the company leaves big shoes to fill. Will Masimo continue to lead with innovations in medical technology devices? Will the consumer business be sold to Apple? Hopefully we don’t find out via a third proxy contest.

Sources

[1]

Masimo Files Complaint Seeking Injunction Requiring Politan to Correct Material Misstatements

[2] Masimo Announces Reinstatement of Import Ban on Infringing Apple Watches

[3] https://finance.yahoo.com/news/politan-capital-hit-contempt-court-163358570.html

[5] https://www.sec.gov/ix?doc=/Archives/edgar/data/937556/000093755624000085/masi-20240925.htm