.png)

Overview

As a sophisticated institutional investor or risk manager we are always looking to avoid blowups. Recently, there were two such cases in the form of Tricolor Holdings and First Brands Group, where recoveries are likely to be minimal. This installment addresses the early warning signs and how to sidestep future problems.

The Motivation

Major credit debacles often occur through acts of desperation, that is, obligors mask the true conditions in an attempt to “fake it until they make it.” While obligors might not see it as fraud, typically it ends up that way, providing little solace to creditors and investors.

The Symptoms

Our premise is that financial shenanigans are typically a symptom of larger problems. In the historic Enron case, the off-balance sheet debt was present because of the fundamental problems in the firm’s business.

Tricolor Problems

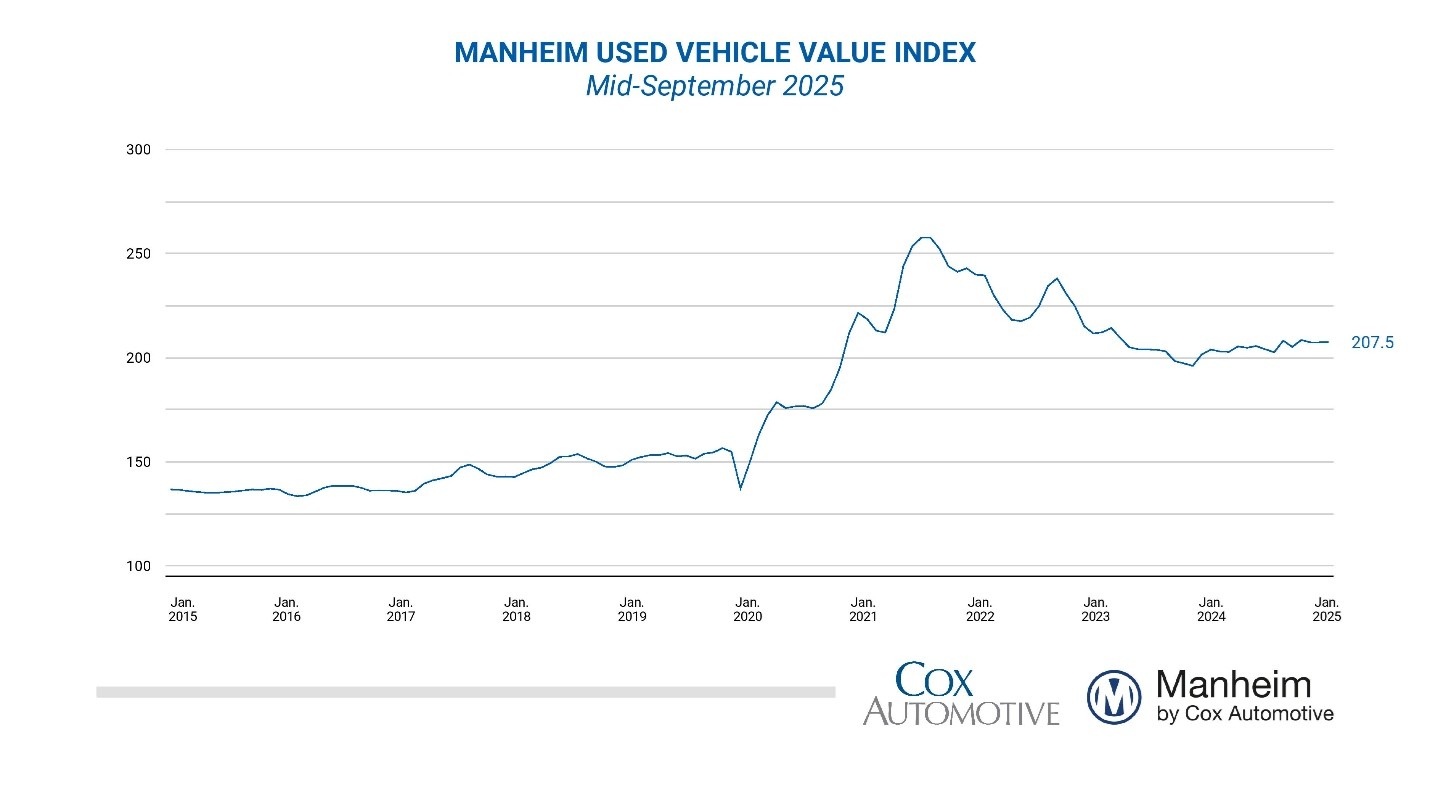

For Tricolor, a subprime auto lender and used car retailer, the business was heading in the wrong direction as the credit quality of obligors was weakening. Further, the value of collateral became increasingly suspect, considering used car values have declined since 2021 and obligors (i.e., the lessees and auto purchasers), who were typically weaker credits, were less likely to store vehicles in garages and or pay for repairs given their tighter budgets.

Obligors have been hit by immigration enforcement, inflation, and a weaker employment market. While there are reports of double-pledging of assets, such actions should have appeared in the company’s financials. For example, if Tricolor borrowed $80 on $100 in collateral and then turned to another lender, what should have been recorded was a total of $160 as liabilities against assets of merely $100. If, through securitization, it sold assets twice to separate structures, a simple UCC search should have identified the problem. While news is still emerging, we suspect the core issue was obligor defaults and difficulty in repossessing and remarketing vehicles.

First Brand Problems

In the case of First Brands, an automotive parts company, the major issues appear to be leverage and acquisition integration. The company conducted five major acquisitions over the past five years, a tall task for any management team. Typically, firms have unique operational aspects that take time to integrate and coordinate. Add tariffs and massive leverage to the mix, and problems are guaranteed. AutoZone, a major customer of First Brands, recorded a 4.8% rise in same-store sales, and therefore, demand does not appear to be an issue.

Broader Message

While both these failures are concerning, the broader message is that the automobile industry has been and remains under pressure due to the massive increase in capacity and tightening margins.

Another indication of the troubles was CarMax’s missing earnings expectations by 37%. The message is clear: despite the rise in the stock market, the lower-income households are hurting from inflation, high borrowing costs, and weaker employment.

Conclusion

Our view is that credit quality shifts ARE predictable. We were fortunate in flagging Enron and WorldCom and in being named number one by Fortune Magazine for warning about the 2008 Credit Crisis. Subsequent columns will discuss tools we found valuable.