Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

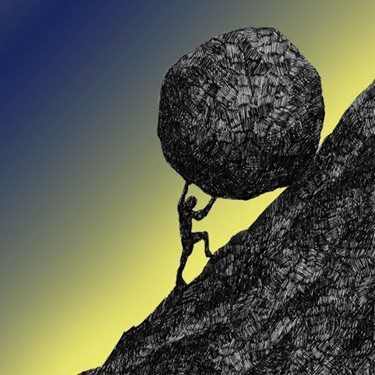

The Sisyphus Syndrome; Forecasting Fallacies

Overview

Economic forecasting is a well-established practice among credit and financial analysts. Our view is that it is appropriate and helpful at the issuer level but more often than not, an exercise in futility at the macro level. Sophisticated risk and portfolio managers are best served by focusing on those areas where they can be successful and engage in scenario analysis for the other areas.

Issuer-Level Evaluations

Prior to taking on an exposure to a particular issuer, it is common to make some basic assumptions about the industry, the issuer’s position in that industry, the issuer’s management, its products, and other relevant factors.

(Note, in the words of Warren Buffett and other successful investors, it is better to invest in a strong industry with weak management than the reverse.) From such evaluation, one can typically reasonably assess revenues, margins, cashflow, in turn valuation metrics. Comparing relative appeal on a risk/ reward basis provides a reasonable basis for decision making.

Industry-Level Evaluations

At this level sound evaluations become more problematic. The reality is that more macro-level evaluations come into play such as overall consumer spending, interest rates, government policies and regulation, alternatives. Furthermore, with the economic turmoil stemming from COVID, high levels of government spending, and the rapid rise in FED funds rates, making predictions on the revenue levels and margins trends by industry is difficult at best; prior patterns are no longer applicable.

Hence, many managers set broad targets and provide some flexibility based on the relative appeal of various opportunities.

Macro-Level Evaluations

In our opinion, making accurate forecasts at this level is extremely difficult. Starting with the notion that a successful forecaster might be correct 65%. On the Ratings side of our firm we have a saying which is to check your politics, religion and sporting views at the door (a policy reminiscent of the rule in the Western saloons of yore of checking one’s firearms at the door). Nonetheless, since politics can have a critical impact on portfolio holdings, this issue addresses some of the dynamics likely at play in the upcoming presidential elections.

A Better Approach

Assuming we are correct in our premise that accurate macro level predictions are extremely difficult, then perhaps a more productive approach is recognizing such futility and focus on those areas which can actually add value.

This content is produced by individuals who are not part of the credit ratings team and do not have responsibilities for determining credit ratings or developing/approving methodologies, models or procedures that are used to determine credit ratings. The views expressed in this article might not parallel the views of the credit ratings team. The information in this report is based on current publicly available information that Egan-Jones Ratings Company (“Egan-Jones”) considers reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein areas of the date hereof and are subject to change without prior notification. Any credit ratings issued by Egan-Jones represent Egan-Jones Rating’s current opinion of the credit risk of the instrument or entity rated. Any such credit ratings do not address other factors or risks such as market volatility, market risk or liquidity risk. Prospective clients should refer to Egan-Jones Rating’s published statements as to the meaning of different credit ratings assigned by Egan-Jones. Credit ratings provided by Egan-Jones are solely intended to be used by institutional investors. Egan-Jones does not assess or address the suitability of any investment for any client or any other person or the marketability of any security or instrument. Any credit rating issued by Egan-Jones is not, and should not be construed as, a recommendation to buy, sell or hold any security or instrument or undertake any investment strategy and EJR does not act as a fiduciary for any person. Egan-Jones may raise, lower, suspend, withdraw or otherwise modify a credit rating at any time in its sole discretion. EGAN-JONES IS NOT LICENSED AS A NATIONALLY-RECOGNIZEDSTATISTICAL RATING ORGANIZATION (“NRSRO”) IN RESPECT OF “ASSET-BACKEDSECURITIES”, “GOVERNMENT SECURITIES”, “MUNICIPAL SECURITIES” OR SECURITIESISSED BY A FOREIGN GOVERNMENT (ALL AS DEFINED IN THE FEDERAL SECURITIES LAWSAND, COLLECTIVELY, THE “EXCLUDED SECURITIES CATEGORIES”) AND ANY RATING ISSUEDBY EGAN-JONES IN RESPECT OF ANY SECURITIES FALLING WITHIN AN EXCLUDEDSECURITIES CATEGORY IS NOT ISSUED BY EGAN-JONES IN ITS CAPACITY AS AN NRSRO. Egan-Jones is not responsible for the content or operation of third-party websites accessed through hypertext or other computer links, cannot guarantee the accuracy of any information provided on an external website and shall have no liability to any person or entity for the use of, or the accuracy, legality or content of, such third party websites. The views attributed to any third party, including any article accessed via computer links, do not necessarily reflect those of, and are not an official view or endorsement of, Egan-Jones. This publication may not be reproduced, retransmitted or distributed in any form without the prior written consent of Egan-Jones. © 2024, Egan-Jones Ratings Company. All rights reserved.

Contact Us

sales@ejproxy.com

(646) 883-9898

1120 Avenue of the Americas

4th Floor

New York, NY 10036