Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Sovereign Credit Quality: Key Drivers

Overview

Typically, issuers are subject to the vicissitudes of the economic environment. Hence a key question is what determines its strength or weakness, and perhaps more importantly, what predictions can be made regarding the future attractiveness. This installment will attempt to address some of the underlying drivers for the relative attractiveness of various environments.

Historical Context

Perhaps some historical context might be helpful. While books have been written about this subject, we will attempt to present some key ideas in an effort to assist readers in quickly providing context.

Starting with early recorded history, Egypt set itself apart from other civilizations by its ability to produce excess food, thus enabling a greater proportion of the population to focus on trades other than agriculture. Egypt also could more easily defend itself by virtue of having deserts on both sides of the Nile basin. For centuries, it was left to prosper because of the initial logistical difficulty in attacking the nation. However, over time, with advancements in marine travel and naval warfare, the nation fell to the First Persian Empire and slipped from prominence. Over time, leadership shifted mainly to those nations which were at the center of development in what appears to be a gradual western movement. The below chart is a simplification, but hopefully catches major factors:

Figure I: Key Strengths of Powerful Civilizations Through History

Underlying Drivers

One might appropriately ask what drives national prosperity. In our view there are multiple factors, but at the same time, there are many similarities. Before proffering some suggestions, we would like to address a real time study of a region which hopefully is fairly telling and that is the Korean peninsula.

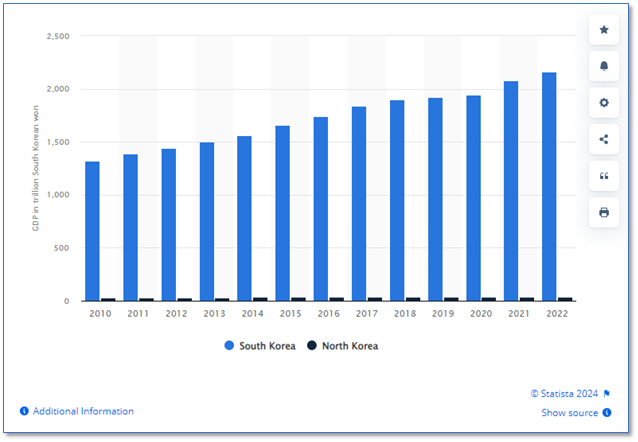

Figure II: South Korea's GDP Growth from 2010 to 2022

A The geography and natural resources of North Korea are not very different from South Korea and yet the GDP is massively different as illustrated above.

Furthermore, the gap has grown over time. In our opinion, an underlying cause is that North Korea is a static, closed society benefiting little from productivity increases. The economy appears to be supported via subsistence-level agriculture, mining (primarily of coal sold to China), and the sale of munitions to Russia. North Korea has received substantial amounts of aid from China, the UN, and the United States in an effort to ease famine concerns

Other Cases

While the differences are stark in the case of the Koreas, other countries have been sidetracked by events, which over time result in a hobbled state and hobbled economy. Argentina is a stark reminder of this; By 1913, Argentina was among the world's ten wealthiest states per capita¹. However, it has defaulted numerous times since then and continues to struggle.

Summary; False Assumptions

Investors might assume that the current state of affairs will last forever, and perhaps unfortunately, the exact opposite is the case. Just like reputations, a country’s prosperity can rapidly suffer. Once lost, it is nearly impossible to regain.

Below are some quick (albeit simplistic) thoughts on various factors:

Geography – The civilizational center of gravity moved westward. First gravity was centered in the Mesopotamian region, then Egypt, then Greece, later Rome and Venice, France, Spain and the Netherlands, England, and lastly, America.

The development of Britain and Russia are helpful examples to understand effects of geography. British and Russian geographic isolation from the rest of continental Europe meant invasion was more difficult and thus favored political stability. British isolation also incentivized naval development and thus the establishment of their global empire.

Both countries’ relatively cooler climates compared to southern Europe incentivized industrialization, though Britain was initially far more successful.

Thus, geographical advantage may be an important factor for success, though is insufficient. While Somalia and Yemen have favorable geography, both countries lack economic strength and political stability. Furthermore, favorable geography becomes less important in an internet-based, service-based world.

Resources – the Arab Gulf states have capitalized on their natural resources and encouraged private-public economic development. Venezuela, despite similar resources, has been hindered by its political system.

Inevitable Decline – Powerful countries often fail to adjust to shifting paradigms. This might be most evident in warfare, whereby less established belligerents must focus on innovative tactics to be effective (e.g. Germany’s use of rail in the Franco-Prussian war or Ukraine’s early use of drones against Russian armored vehicles).

However, economic paradigms also shift and societies with bureaucratic bloat and economic rigidity (often caused by insufficient competition and entrenched incumbents) may also fail to adjust. Thus, short-run, concentrated economic interests may be prioritized over long-run, diluted economic interests. Stated otherwise, often societies can slip into decline by neglecting the factors that made them successful at the onset.

Lastly, one should consider reversion to the mean. Early outperformance among nations is difficult to maintain as it is among corporations.

Sources

[1] Spruk,Rok (2019). "The rise and fall of Argentina". Latin American Economic Review. 28 (1): 16. doi:10.1186/s40503-019-0076-2. ISSN 2196-436X

This content is produced by individuals who are not part of the credit ratings team and do not have responsibilities for determining credit ratings or developing/approving methodologies, models or procedures that are used to determine credit ratings. The views expressed in this article might not parallel the views of the credit ratings team. The information in this report is based on current publicly available information that Egan-Jones Ratings Company (“Egan-Jones”) considers reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein areas of the date hereof and are subject to change without prior notification. Any credit ratings issued by Egan-Jones represent Egan-Jones Rating’s current opinion of the credit risk of the instrument or entity rated. Any such credit ratings do not address other factors or risks such as market volatility, market risk or liquidity risk. Prospective clients should refer to Egan-Jones Rating’s published statements as to the meaning of different credit ratings assigned by Egan-Jones. Credit ratings provided by Egan-Jones are solely intended to be used by institutional investors. Egan-Jones does not assess or address the suitability of any investment for any client or any other person or the marketability of any security or instrument. Any credit rating issued by Egan-Jones is not, and should not be construed as, a recommendation to buy, sell or hold any security or instrument or undertake any investment strategy and EJR does not act as a fiduciary for any person. Egan-Jones may raise, lower, suspend, withdraw or otherwise modify a credit rating at any time in its sole discretion. EGAN-JONES IS NOT LICENSED AS A NATIONALLY-RECOGNIZEDSTATISTICAL RATING ORGANIZATION (“NRSRO”) IN RESPECT OF “ASSET-BACKEDSECURITIES”, “GOVERNMENT SECURITIES”, “MUNICIPAL SECURITIES” OR SECURITIESISSED BY A FOREIGN GOVERNMENT (ALL AS DEFINED IN THE FEDERAL SECURITIES LAWSAND, COLLECTIVELY, THE “EXCLUDED SECURITIES CATEGORIES”) AND ANY RATING ISSUEDBY EGAN-JONES IN RESPECT OF ANY SECURITIES FALLING WITHIN AN EXCLUDEDSECURITIES CATEGORY IS NOT ISSUED BY EGAN-JONES IN ITS CAPACITY AS AN NRSRO. Egan-Jones is not responsible for the content or operation of third-party websites accessed through hypertext or other computer links, cannot guarantee the accuracy of any information provided on an external website and shall have no liability to any person or entity for the use of, or the accuracy, legality or content of, such third party websites. The views attributed to any third party, including any article accessed via computer links, do not necessarily reflect those of, and are not an official view or endorsement of, Egan-Jones. This publication may not be reproduced, retransmitted or distributed in any form without the prior written consent of Egan-Jones. © 2024, Egan-Jones Ratings Company. All rights reserved.

Contact Us

sales@ejproxy.com

(646) 883-9898

1120 Avenue of the Americas

4th Floor

New York, NY 10036