Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Hearts, Minds, and Votes: Where Smarter Wealth Managers Win

As An entire financial planning industry has been built on the idea that true success is measured not by the size of wealth alone but by how effectively that wealth reflects values and supports a blueprint for a fulfilling life.¹ Whether mapping assets towards a retirement, college, or a (third) wedding, top-tier wealth managers are constantly utilizing that golden axiom in portfolio construction to build deeper, purposeful, and ultimately more valuable relationships with their clients.

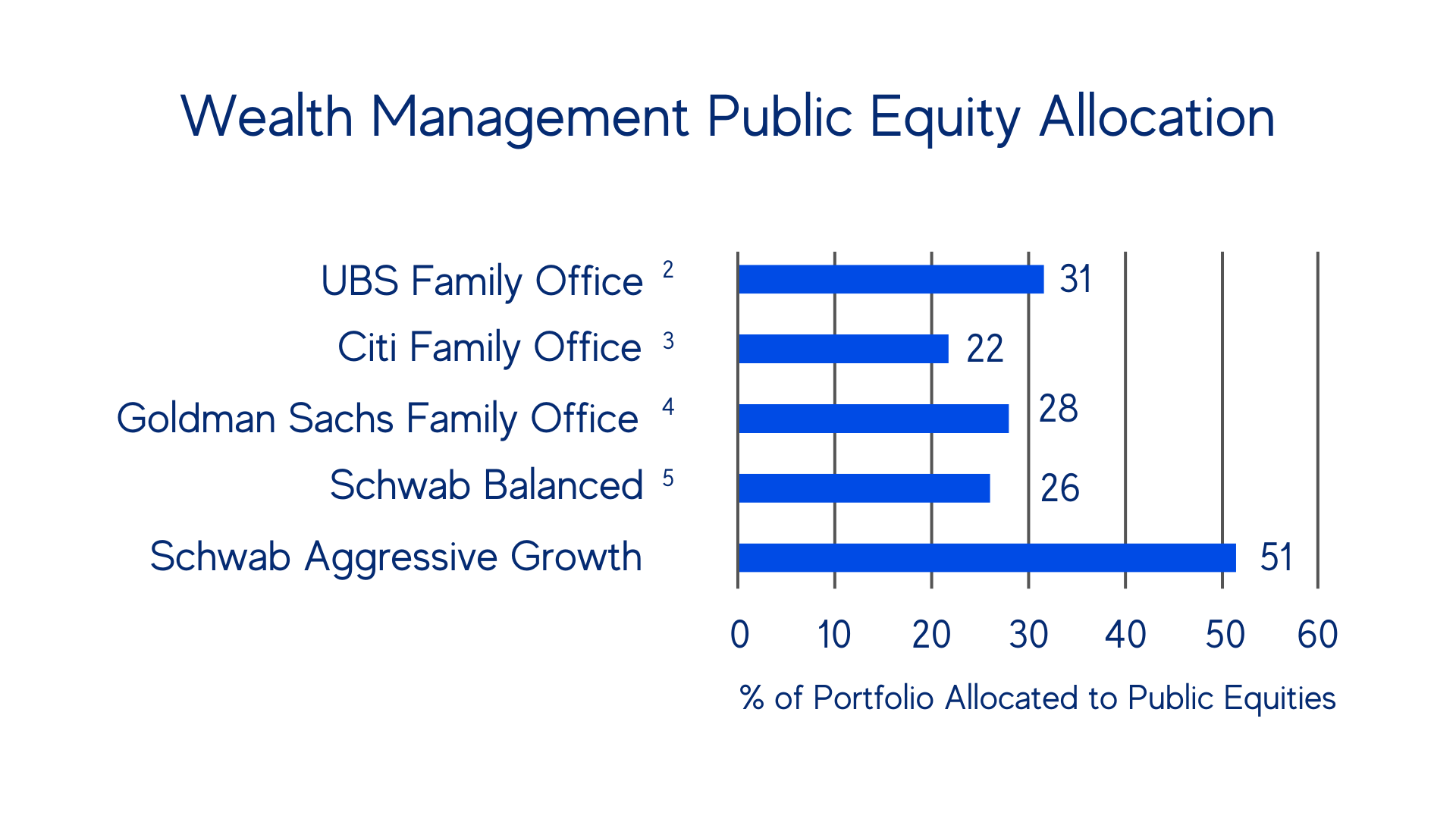

But once that portfolio has been built, certain forward-thinking clients and advisors will still be looking for ways to engage with those positions. While this may not be possible for all assets classes, for the 20-30%+ of a portfolio allocated to public equities, voting those shares is not just in the realm of reality, it’s the right thing to do.

How to Engage

Every year, at the annual meeting, disparate shareholders assemble to vote on the direction of the company from electing directors to strategic (or misguided) initiatives. It is the chance for a wealth manager to make their clients’ voices heard.

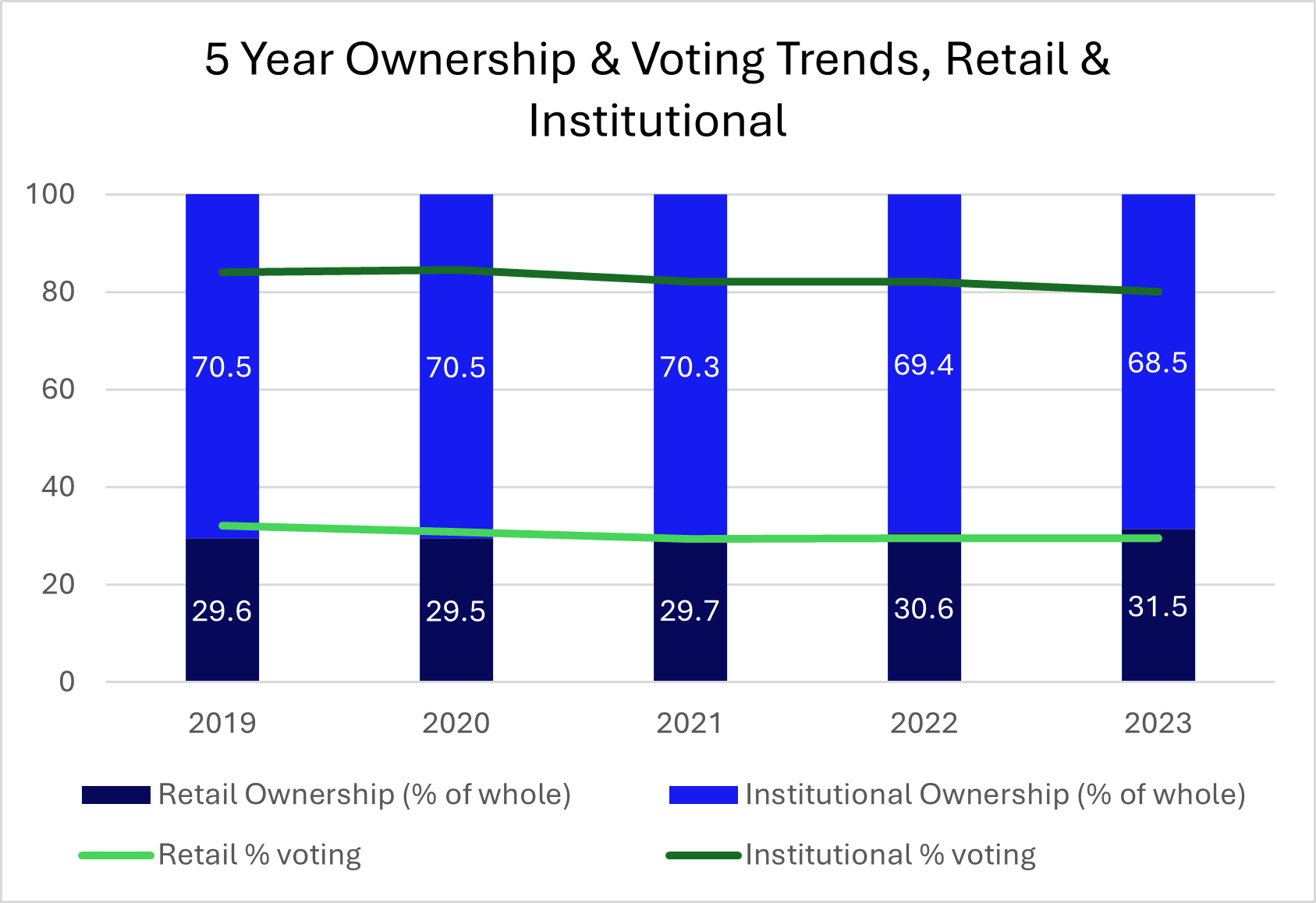

This is no trivial matter. In the past five years, retail ownership (vs institutional ownership) of public companies has marginally increased. On the other hand, the share of those retail investors participating in share voting has dropped by nearly 8%, standing at a paltry 29%.⁶ Given these trends, a savvy wealth manager would spot an opportunity to step ahead of the competition and engage with clients around corporate governance and change agendas. A conscientious wealth manager would spot an opportunity to further conversations with clients around core values and purposeful wealth.

It would, however, be offensively profligate for a wealth manager to research every votable issue at every meeting of every company. Partnering with service providers like Egan-Jones Proxy Services is a cost- and timesaving exercise to get smart on voting issues, options, and recommendations, fast. Having been provided coverage for the entire universe of US listed and OTC equities, wealth managers can feel reassured with immediate access to wide ranging hip-pocket knowledge while being empowered to spend more time on value-additive client interactions.

Avoid Landmines

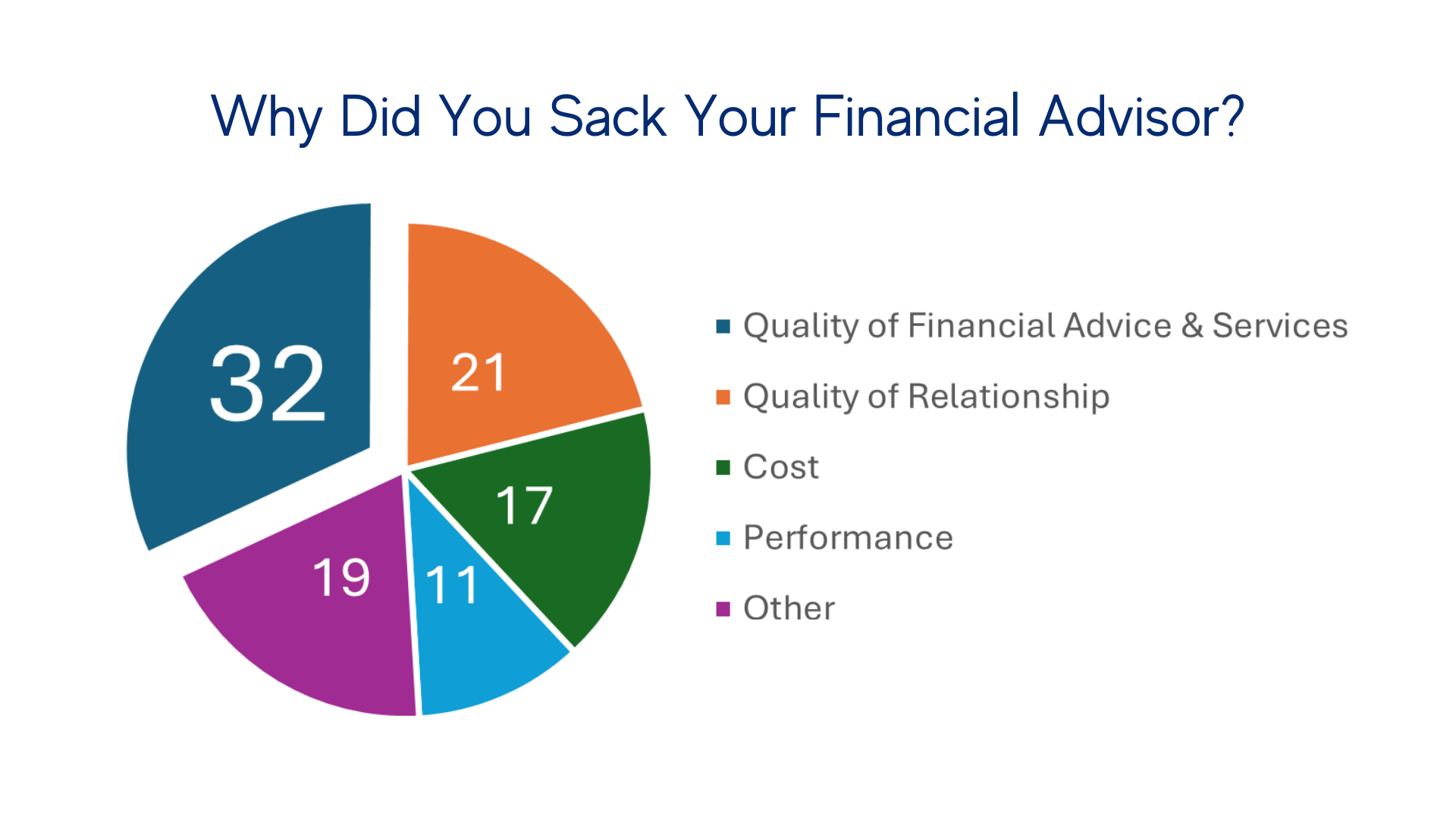

Nearly one third of advisors who are fired by their clients are shown the door due to “Quality of Financial Advice & Services,” according to a recent Morningstar study—more than cost and performance combined!⁷ Although the study defines “mismatch in values” as a subcategory of “Quality of Financial Advice & Services,” one could easily see that values mismatch devolving further and degrading the “Quality of Relationship.”

In regards to applying this thinking to governance broadly and annual meetings in particular, this is one of the only opportunities for a wealth manager to leverage an investment portfolio in putting her clients’ values into effect, and there are only two scenarios for consideration here.

Either:

- A client isn’t interested in voting their shares, or;

- A client is interested in voting their shares.

If a manager meets this clients’ interest by issuing votes themselves, voting consistency and transparency is wrought with risk.

Choosing the Correct Policy

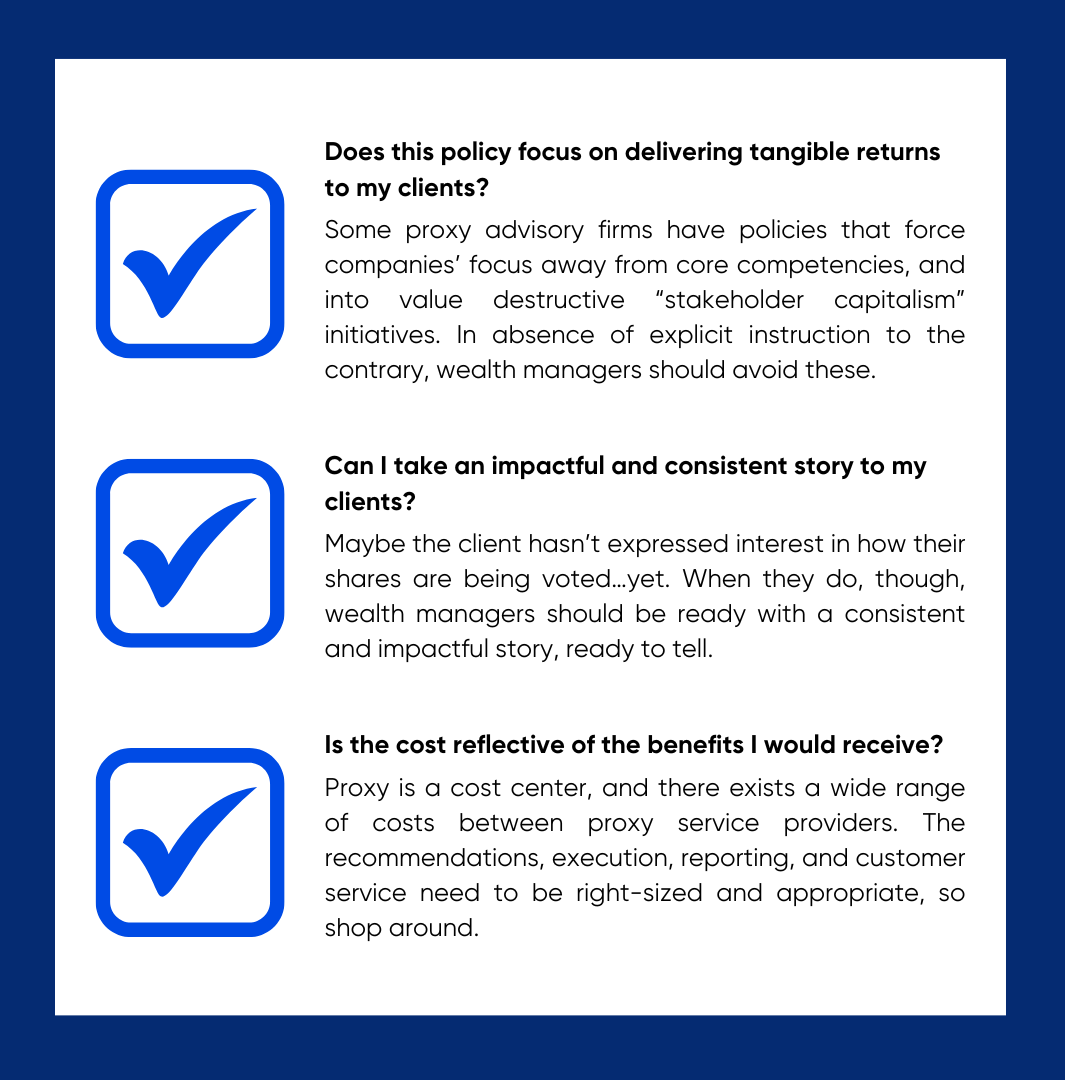

Using a proxy provider’s policy guidelines is a simple way to structure conversations with clients around how their shares should and will be voted. Through these policies, wealth managers can take those generalized client preferences and transform them into specified action, once again resting assured that enterprise grade resources are being brought to bear in analyzing the entire market to form meaningful recommendations. Where a client has expressed no preference and the discretion lies with the wealth manager, however, how would a thoughtful wealth manager evaluate these options?

Egan-Jones Proxy Services has prepared a brief mental checklist for wealth managers to streamline this task.

By using a systematic review process with clearly articulated evaluation criteria and desired outcomes, wealth managers set themselves up for success with a defensible, ex-ante decision making process.

As the wealth management industry evolves with a focus on advice and beyond, wealth managers should always be thinking about how to further align their clients, investments, and recommendations in a way that stands apart from the competition. Wealth managers looking to tool that alignment should absolutely be adding a carefully considered proxy strategy to their kit, and in doing so will find true success in building, maintaining, and marshalling fulfilling wealth.

Sources

[1] https://emoneyadvisor.com/blog/goal-based-financial-planning-for-all-life-stages/

[2] https://www.ubs.com/global/en/family-office-uhnw/reports/global-family-office-report-2023.html

[3] https://www.privatebank.citibank.com/insights/the-family-office-survey

[4] https://www.goldmansachs.com/intelligence/pages/gs-family-office-investment-insights-report/

[5] https://www.schwab.com/managed-portfolios/asset-allocation

[6] https://www.broadridge.com/_assets/pdf/broadridge-proxypulse-2023-proxy-season-review.pdf

Contact Us

sales@ejproxy.com

(646) 883-9898

1120 Avenue of the Americas

4th Floor

New York, NY 10036