Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Massive Sea Change

Overview

In the past, to be a sea power one required a navy. Likewise, to be a land power, one required an army. Currently, neither of the prior statements are true and the implications are massive, and they will soon be rippling through the economy.

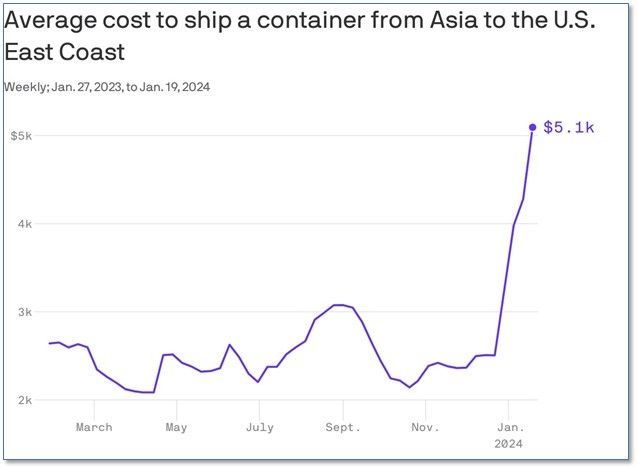

Sea wars without navies – The ragtag Houthi rebels in Yemen have no navy yet are able to blockade the Red Sea. Forget the shocking videos of explosions of allied missiles hitting rebel camps, the real story on the ground (or rather, sea) is that major shipper AP Moller-Maersk and most other shippers are avoiding the Suez Canal and the Red Sea presumably because of extraordinary insurance premium levels. Thus, 40% more time has been added to voyages. One of the busiest trade routes in the world has been shuttered.

Figure I: Asia to U.S. East Coast Average Container Shipping Cost

Another example is Ukraine, whereby a country without a navy has been able to counter one of the world’s largest navies. (Ukraine has sunk numerous vessels with missiles and small boat drones.)

Impact – While the impact of Ukraine’s efforts already has been factored into global economies, for the most part, the Red Sea has not. Effectively, the global shipping industry has been hit with a massive reduction in supply courtesy of the Red Sea disaster and might be further impacted by the continuing capacity constraints of the Panama Canal¹. Regarding the impact, the below quote should be helpful:

“The fund [i.e., the IMF] estimates that the doubling of freight rates leads to a 0.7 percentage point increase in inflation, with the effects peaking after a year and lasting up to 18 months.”²

Hence, inflation might rise by 1% more than would have been the case without the rise in shipping costs. However, for some, the impact is more dramatic; both Tesla and Volvo have cut production in their European factories because of the lack of parts.

Just as supply constraints were a major cause of the prior inflationary burst, similar constraints are emerging. Assuming the lead time for shipping disruptions translate into inflationary pressure is six months, we might see pressure in May or June, which is particularly sensitive given the November presidential elections.

Land wars without armies – In prior wars, one needed an army to stop an army. With the widespread use of drones, traditional formulas are quickly being set aside. Hundred-dollar drones now appear capable of destroying multi-million-dollar tanks. Additionally, some of the more advanced drones can hit targets far behind front lines. Thermal imaging makes acquiring targets, including personnel, relatively easy.

Impact – A handful of relatively inexpensive (less than a few hundred dollars) drones have the capacity of blunting and in many cases stopping sophisticated armies. Taking this one step further, a swarm of drones is unlikely to be stopped by the most sophisticated defenses. Perhaps it is only a matter of time before we see this play out on a highly valued target.

What Has Changed – There are several factors at play which have brought us to this state.

- Commoditization of Weaponry - sophisticated military technology has been commoditized. It appears that non-Western nations (probably Iran and perhaps indirectly China) have provided the Houthis with the weaponry to accurately target vessels.

- Decentralized Adversaries - Given the decentralized nature and the mobility of the Houthis, it is likely to prove difficult to counter their efforts.

- Multipolar World - we are no longer dealing with a unipolar world. The sanctions against Russia are ineffective as it can obtain revenue by selling oil to India and China. Furthermore, it can still sell natural gas to the EU but at suppressed prices.

- Dependency of Western Europe - Germany and other western European nations are dependent on relatively inexpensive Russian natural gas and petroleum and therefore not willing to provide Ukraine with the means to “win” the war, but rather to not “lose” it to date. Furthermore, voices in the Republican party are questioning the level of the US’s commitment.

- Aversion to escalation - Putin has expressed willingness to use nuclear weapons which appears to have cowed some. Given the Houthis attacks in the Strait of Hormuz and the deaths of three Americans at Tower 22, the current administration is concerned that a stronger response will spark a broader conflict.

- Importance of Cheap Manufacturing –

Given that many cheap weapons (e.g. drone boats) can overwhelm expensive weapon platforms (e.g. aircraft carriers), the defense manufacturing paradigm has shifted. Legacy defense companies have specialized in developing expensive platforms. However, reliance on this dated paradigm combined with the West’s aversion to cheap domestic manufacturing and resource development may hinder its capability to respond to future conflicts. Already, the cost of a response by the US outweighs the cost of an attack by the Houthis by orders of magnitude.

Implications for Risk and Portfolio Managers

From a strategic perspective, the current state of affairs is unappealing as the Ukraine War and Red Sea attacks are expensive. The situation does not appear to be improving and the current administration is likely to be blamed for additional expensive, endless wars. Unfortunately, there are no easy answers.

Sources

[1] https://www.nytimes.com/2023/11/01/business/economy/panama-canal…

[2] https://www.imf.org/en/Publications/fandd/issues/2023/03/the-costs-of-misreading…

This content is produced by individuals who are not part of the credit ratings team and do not have responsibilities for determining credit ratings or developing/approving methodologies, models or procedures that are used to determine credit ratings. The views expressed in this article might not parallel the views of the credit ratings team. The information in this report is based on current publicly available information that Egan-Jones Ratings Company (“Egan-Jones”) considers reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein areas of the date hereof and are subject to change without prior notification. Any credit ratings issued by Egan-Jones represent Egan-Jones Rating’s current opinion of the credit risk of the instrument or entity rated. Any such credit ratings do not address other factors or risks such as market volatility, market risk or liquidity risk. Prospective clients should refer to Egan-Jones Rating’s published statements as to the meaning of different credit ratings assigned by Egan-Jones. Credit ratings provided by Egan-Jones are solely intended to be used by institutional investors. Egan-Jones does not assess or address the suitability of any investment for any client or any other person or the marketability of any security or instrument. Any credit rating issued by Egan-Jones is not, and should not be construed as, a recommendation to buy, sell or hold any security or instrument or undertake any investment strategy and EJR does not act as a fiduciary for any person. Egan-Jones may raise, lower, suspend, withdraw or otherwise modify a credit rating at any time in its sole discretion. EGAN-JONES IS NOT LICENSED AS A NATIONALLY-RECOGNIZEDSTATISTICAL RATING ORGANIZATION (“NRSRO”) IN RESPECT OF “ASSET-BACKEDSECURITIES”, “GOVERNMENT SECURITIES”, “MUNICIPAL SECURITIES” OR SECURITIESISSED BY A FOREIGN GOVERNMENT (ALL AS DEFINED IN THE FEDERAL SECURITIES LAWSAND, COLLECTIVELY, THE “EXCLUDED SECURITIES CATEGORIES”) AND ANY RATING ISSUEDBY EGAN-JONES IN RESPECT OF ANY SECURITIES FALLING WITHIN AN EXCLUDEDSECURITIES CATEGORY IS NOT ISSUED BY EGAN-JONES IN ITS CAPACITY AS AN NRSRO. Egan-Jones is not responsible for the content or operation of third-party websites accessed through hypertext or other computer links, cannot guarantee the accuracy of any information provided on an external website and shall have no liability to any person or entity for the use of, or the accuracy, legality or content of, such third party websites. The views attributed to any third party, including any article accessed via computer links, do not necessarily reflect those of, and are not an official view or endorsement of, Egan-Jones. This publication may not be reproduced, retransmitted or distributed in any form without the prior written consent of Egan-Jones. © 2024, Egan-Jones Ratings Company. All rights reserved.

Contact Us

sales@ejproxy.com

(646) 883-9898

1120 Avenue of the Americas

4th Floor

New York, NY 10036